Services

Home » Services

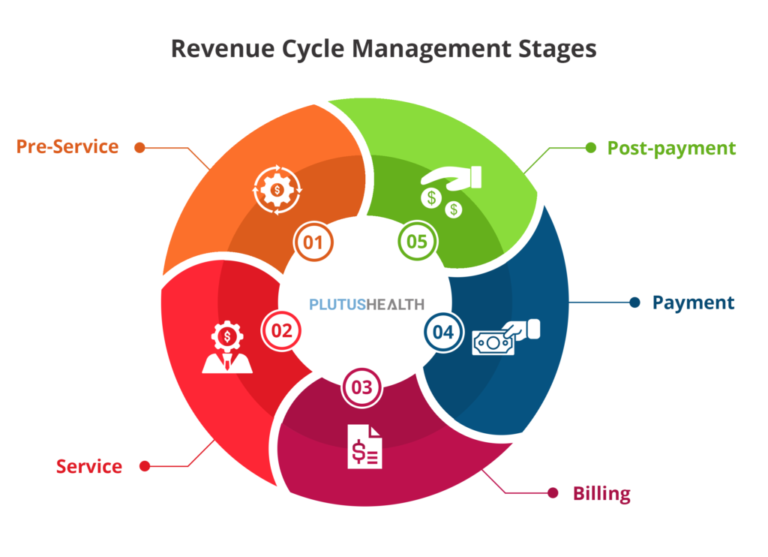

- Comprehensive Revenue Cycle Review – Conduct end-to-end analysis of billing, coding, claims submission, and reimbursement processes to identify inefficiencies.

- First-Pass Claim Rate Improvement – Enhance clean claim submissions by ensuring proper coding, documentation, and payer-specific compliance.

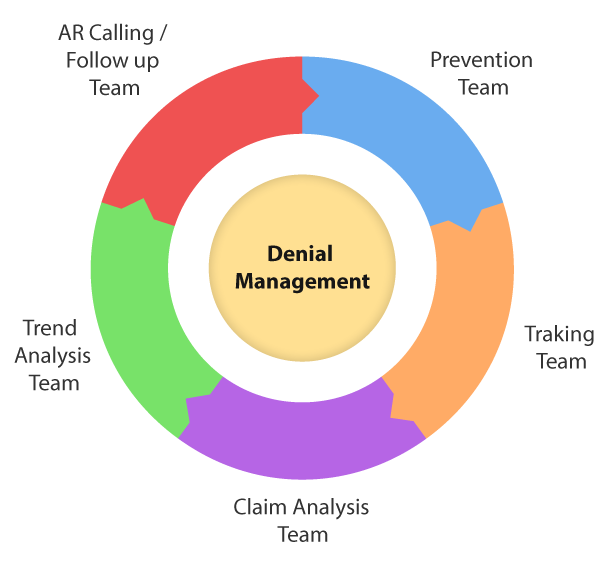

- Denial Root Cause Analysis – Identify patterns in claim denials to address common issues such as coding errors, missing documentation, or authorization problems.

- Denial Management & Prevention – Analyze common denial trends, implement root cause analysis, and apply best practices to reduce rejection rates.

- Accounts Receivable (A/R) Optimization – Improve collections by identifying aged claims, implementing follow-up protocols, and reducing A/R days.

- Financial & KPI Benchmarking – Track and report key performance indicators (KPIs) such as Days in A/R, Net Collection Rate, and Denial Rate to measure revenue cycle health.

- Revenue Leakage Identification – Uncover missed billing opportunities, underpayments, or denied claims that can be recouped.

- Denial Root Cause Analysis – Identify patterns in claim denials to address common issues such as coding errors, missing documentation, or authorization problems.

- Proactive Denial Prevention – Implement front-end processes, including eligibility verification, prior authorizations, and accurate coding, to reduce denials before they occur.

- Payer-Specific Denial Analysis – Review denial trends by insurance payer to adjust billing practices and negotiate more favorable reimbursement terms.

- Coding & Modifier Accuracy – Ensure the correct application of CPT, ICD-10, and HCPCS codes, along with necessary modifiers, to prevent claims from being flagged as incomplete or incorrect.

- Timely Follow-Up & Resolution – Implement workflows to ensure that denied claims are corrected and resubmitted within payer deadlines to maximize reimbursement.

- Continuous Process Improvement – Regularly review and refine revenue cycle workflows based on denial trends and industry benchmarks to increase overall revenue recovery.

- Denial Dashboard & KPI Monitoring – Track key denial management metrics such as denial rate, appeal success rate, and recovery percentage to continuously improve processes.

- Eligibility & Benefits Verification – Confirm active coverage, copays, deductibles, and out-of-pocket costs before services are rendered.

- Coordination of Benefits (COB) Review – Determine primary vs. secondary insurance to ensure proper claims submission.

- Verification of In-Network vs. Out-of-Network Status – Confirm if the provider is in-network or out-of-network with the patient’s insurance plan.

- Prior Authorization Requirement Check – Identify procedures, medications, and treatments that require pre-approval.

- Submission of Authorization Requests – Submit PA requests via payer portals, fax, or phone with all required documentation.

- Follow-Up & Expedited Processing – Track pending authorizations and escalate urgent cases when needed.

Financial Reporting & Analysis

- Revenue Cycle Performance Metrics – Track and analyze key indicators such as days in A/R, net collection rate, first-pass claim acceptance rate, and denial rate to assess financial health.

- Cash Flow Analysis – Monitor incoming payments, outstanding claims, and operational expenses to ensure liquidity and financial stability.

- Accounts Receivable (A/R) Aging Report – Analyze outstanding claims by payer and aging bucket (0-30, 31-60, 61-90 days) to prioritize collections and reduce write-offs.

- Denial Trend Analysis – Identify common denial reasons and their financial impact to implement corrective measures that improve reimbursement rates.

- Provider Revenue Analysis – Assess individual provider performance by tracking billing patterns, reimbursement rates, and service volumes to optimize revenue generation.

- Payer Reimbursement Analysis – Compare reimbursement rates across different payers and identify underpayments or contract discrepancies.

- Initial Provider Enrollment with Payers – Assist providers in enrolling with Medicare, Medicaid, and commercial insurance networks to establish in-network status.

- CAQH Profile Setup & Maintenance – Ensure accurate and up-to-date provider profiles in the Council for Affordable Quality Healthcare (CAQH) ProView system for payer credentialing.

- NPI Registration & Taxonomy Code Assignment – Obtain or update the National Provider Identifier (NPI) and ensure correct taxonomy codes for billing compliance.

- Contract & Fee Schedule Negotiation – Assist providers in negotiating payer contracts and ensuring they receive competitive reimbursement rates.

- Delegated Credentialing Management – Support group practices and organizations in managing credentialing for multiple providers.

- State Licensing & DEA Registration Assistance – Help providers obtain or renew state medical licenses and DEA registrations for prescribing privileges.

- Post insurance and patient payments into the billing system.

- Identify and correct underpayments and payment discrepancies.

- Provide detailed financial reporting for providers.